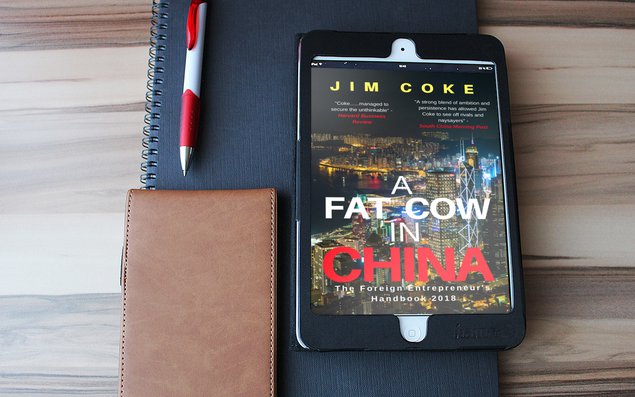

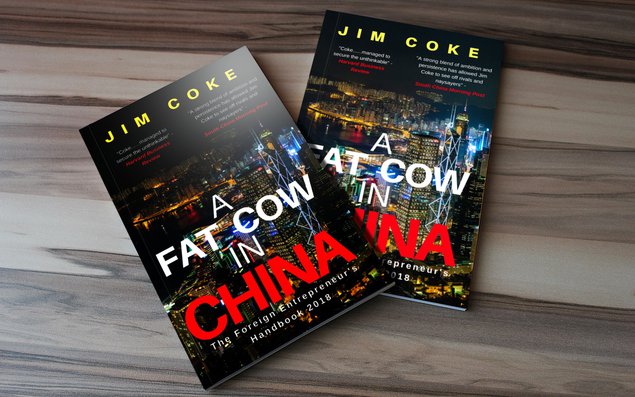

The Foreign Entrepreneur's Handbook 2018

A Fat Cow in China is a comprehensive no-nonsense, no holds barred guide on how a foreign entrepreneur can set up a business in China.

Ended

A Fat Cow in China is a comprehensive no-nonsense, no holds barred guide on how a foreign entrepreneur can set up a business in China. Too often, books on the subject are tech heavy, based on personal anecdotal evidence and backwards-looking. A Fat Cow in China is based heavily on actual research I conducted over a 7-year period and from my personal experience of building my own business in the region. The book is finally backed up by my doctoral research on Chinese market entry and attempts to be forward-looking by nature. This book will connect with small business owners and aspiring entrepreneurs who have an interest in Asia in general and China particularly. There are also general lessons to be learned about entering emerging markets. This book attempts to set out a roadmap for beginning a start-up in China.

The fundamentals can easily be applied to any part of the world, but the contents have been geared towards China, using Hong Kong as the preferred starting point. No knowledge of the region is assumed, and the reader is expected to use this book as a springboard for further investigation - particularly as Chinese laws and regulations can change overnight. Furthermore, this is the first edition and a new edition will be updated and produced at the beginning of each new year in order to keep abreast of the changing legal and business environment in China. This will be the first forward-looking annual compendium on entry into the Chinese market.

The book is divided into 17 parts beginning with the first two that introduce the reader to China’s economic past as well its present transformative trajectory. The book goes on to offer suggestions on how to generate business ideas, especially those that will be implementable in China given its unique cultural disposition. Then the book looks at specific pre-launch strategies that an entrepreneur will find helpful, then goes into the fundamentals of execution such as creating companies, getting partners, raising finance, creating prototypes and all the sales and marketing techniques that bring success in the region. The next few parts focus on specific market entry routes and e-commerce in China followed by helpful tips on expanding a business across the different regions and territories. The book finally ends with a chapter on current research on entrepreneurship and gives the results of a survey conducted on non-Chinese China-based entrepreneurs. To conclude, the book offers a flowchart of where an entrepreneur should begin and what steps should be followed at each stage.

PART 1 - WELCOME TO CHINA

Chapter 1 - China’s global position

Chapter 2 - Chinese Entrepreneurship

Chapter 3 - China – former hyperpower

Chapter 4 - The rise of Chinese Entrepreneurship

Chapter 5 - Misconceptions about China

Chapter 6 - Taiwan: problem or opportunity?

PART 2 - MODERN CHINA

Chapter 7 - China’s future

Chapter 8 - RMB & China’s new economic policy

Chapter 9 – 21st century Hong Kong

Chapter 10 - An economic gateway into China

PART 3 - IDEATION

Chapter 11 - Supply Chain Economics

Chapter 12 - Price Arbitrage

Chapter 13 - Understanding Chinese culture

Chapter 14 - Pivoting ideas

PART 4 - PRE-LAUNCH STRATEGIES

Chapter 15 - Borrow something from home

Chapter 16 - Internet of Things (IoT)

Chapter 17 - Sell/serve yourself

Chapter 18 - Our man/woman in China

Chapter 19 - Creating a name and brand

PART 5 - EARLY STAGE EXECUTION

Chapter 20 - Setting up a company

Chapter 21 - Immigration & Visas

Chapter 22 - Staff employment

Chapter 23 - Office and administration

Chapter 24 - Pitching & Business Plans

Chapter 25 - Licenses & Permits

PART 6 - RAISING FINANCE

Chapter 26 - Friends, Family & Fūērdāi

Chapter 27 - Angel investors

Chapter 28 - Crowdfunding

Chapter 29 - Bootstrapping

Chapter 30 - Venture capital

PART 7 - PARTNERSHIPS & ENTITIES

Chapter 31 - Agents, brokers & intermediaries

Chapter 32- Joint ventures in Mainland China

Chapter 33 - Local partners in Hong Kong

Chapter 34 - PRC entities: RO, WFOE, JV & FIPE

PART 8 - LAUNCHING

Chapter 35 - Prototypes

Chapter 36 - Market validation

Chapter 37 - Intellectual Property

Chapter 38 - Launch: Soft and Hard?

Chapter 39 - KYC and Due diligence

PART 9 - SALES, MARKETING & NEGOTIATIONS

Chapter 40 - Sales strategies & tiered cities

Chapter 41 - Digital marketing

Chapter 42 - Agents & Distributors

Chapter 43 - Negotiations

Chapter 44 - Chinese stratagems – know thy enemy

PART 10 - GUANXI & NETWORKING

Chapter 45 - Network list

Chapter 46 - Business & cultural behaviour

Chapter 47 - Red packets and brown envelopes

Chapter 48 - Red Packets

PART 11 - E-COMMERCE MARKET

Chapter 49 - China’s B2C e-commerce market

Chapter 50 - China’s B2B e-commerce market

Chapter 51 - Cross-border e-commerce (CBEC)

Chapter 52 - Building a social media audience

PART 12 - FREE TRADE ZONES (FTZ)

Chapter 53 - The economics of China’s FTZ

Chapter 54 - Shanghai FTZ

Chapter 55 - FTZ vs CEPA

Chapter 56 - Taking advantage of a FTZ

PART 13 - FREE TRADE AGREEMENTS (FTA)

Chapter 57 - Leveraging Hong Kong’s CEPA

Chapter 58 - Leveraging Macao’s CEPA

Chapter 59 - How to use CEPA

Chapter 60 - China’s free trade agreements

PART 14 - GROWING IN CHINA

Chapter 61 - Race and discrimination

Chapter 62 - Cash flow

Chapter 63 - Growth across China

Chapter 64 - Awards, endorsements & prizes

Chapter 65 - Crack’d Mirror Syndrome

PART 15 - ENTREPRENEURSHIP RESEARCH

Chapter 66 - History of Entrepreneurship

Chapter 67 - Entrepreneurship Theories

PART 16 - RESEARCH SURVEY

Chapter 68 - Conclusion

Chapter 69 - Results

PART 17 - WHAT TO DO NEXT………

China’s fall and rise as a superpower has generated a lot of research but its economic power, global position and the size of its market also attracts a lot of entrepreneurs. In addition to its economic might, three recent events have made conditions favourable for foreign entrepreneurs and overseas investments. Firstly, China has created its own ‘World Bank’ (The Asian Infrastructure Investment Bank), it has revived the Old Silk Road into a One Belt One Road Initiative (OBOR) and finally, it is rebalancing its economy by the internationalization of the Renminbi. All three make a compelling case for entrepreneurs entering the Chinese market.

In the US

The rising interest in entrepreneurship has become a regular topic amongst academics and politicians the world over. For the past 10 years in the US alone, an average of 600,000 new businesses were set-up each year. There is also a significant increase in endowments received by business schools in the U.S. for entrepreneurship activities, programmes and courses. Since 1995 US$100 million has been contributed compared to an average of US$500,000 to US$1 million in the early 1990s. Even the Global Entrepreneurship Monitor (GEM) conducted studies in 40 different countries and saw a sharp increase in entrepreneurship from 2% to 29%.

In the UK

Brexit means that Britain potentially has to negotiate over 20 international trade deals which involve or affect more than 100 countries; a mammoth task since Britain has not negotiated a single trade deal in forty years. Why is a trade deal with China so important to the UK? According to the Office for National Statistics, the top 10 counties which the UK runs a trade deficit are in the EU except for China which happens to be the second largest after Germany. Once Britain leaves the EU, it will have an economic imperative to negotiate a trade agreement with its second largest creditor nation and it is expected that British entrepreneurs will seek opportunities in China.

This book is especially for the forward-looking observers who understand the inevitable.

· New businesses – the downsizing of big firms has produced a lot of people starting out on their own and China is the biggest market for their product or service.

· Freelancers – the use of technology allows many freelancers to generate additional incomes streams and China has a lot of untapped opportunities for that. More so, the internet has made a once inaccessible China very accessible.

Solopreneurs and Wantapreneurs – a few people you probably know have a great idea but are clueless on how to make it a reality – this book shows them the basics from registering trademarks to developing prototypes, to thinking about launches, VCs & angels and their cash flow.

To begin with I have created a dedicated website for the book, www.afatcowinchina.com and will use the following techniques to promote the site which will have a link to the Publishizer crowdfunding page:

· Create key social media accounts using A Fat Cow in China name – www.knowem.com will be used to identify the social media accounts which are still available

· Register an account on the HootSuite platform (www.hootsuite.com) to manage all the social media accounts from one portal.

· Add 25,000 SEO contextual backlinks and 800 SEO social bookmarks to the site,

· Set up an Adwords PPC campaign as well as use Adroll for retargeting once visitors land on the site,

· Employ Influencer Marketing through key opinion leaders on third party providers (e.g. www.buzzstream.com) to notify the public of the pre-orders.

· Use LeadDyno affiliate marketing (www.leaddyno.com) to offer third party commissions on pre-order sales.

1. Michelini, M (2015): Destination China: Entrepreneur's Journey From Wall Street to Business in China

Destination China is a very interesting story of an American banker’s personal account of setting up an online business in the US before moving to China. He charts his personal story with some action points and reflects on some of the choices he made. The book, however, is not a ‘How to’ book but a ‘How I did’ book. A Fat Cow in China is the former backed up with rigorous research on the subject which can stand up to both practical and academic scrutiny.

https://www.amazon.com/Destination-China-Entrepreneurs-Journey-Business-ebook/dp/B00VGEKG3A

2. Michelini, M (2016): China Startup: Experience & Insights. A Foreigner Starting a Chinese Tech Startup

Michael Michelini’s sequel to Destination China follows the same approach; describing the journey from a personal experience as a foreigner. This sequel, however, focuses more on tech start-ups and unfortunately excludes the vast majority of businesses that are not technologically driven. A Fat Cow in China focusses on all types of businesses.

3. Fernandez, J & Underwood, L (2009): China Entrepreneur: Voices of Experience from 40 International Business Pioneers

The combination of Prof. Fernandez and Ms Underwood’s expertise has given this sequel to China CEO the much-needed boost for the small business audience. They interviewed 40 non-Chinese China-based entrepreneurs, 9 foreign representatives and 3 Chinese China-based experts on entrepreneurship. Although nearly 10 years old, this book still holds some relevant lessons to the entrepreneur today. A Fat Cow in China was written with the same principle in mind, conducting a survey on non-Chinese business people about their thoughts on entrepreneurship in the region. I think A Fat Cow in China will replace China Entrepreneur as the go-to book for the small business owner because a new edition will be released every year to keep up with the changing Chinese business landscape and legislation; something China Entrepreneur failed to do as it is a backwards-looking book.

Jim spent seven years in China building a gourmet coffee business. Now he shares his knowledge of Chinese market entry from personal experience and his doctoral thesis.

250 copies • Completed manuscript.

Atlantic Publishing has been providing millions of readers information to jumpstart their careers, start businesses, manage employees, invest, plan for retirement, learn technologies, build relationships, and live rewarding, fulfilling lives. Our award-winning authors and publication staff strive to make our products the best and most up-to-date available. We go further than most publishers to get our customers the best products.

500 copies • Complete manuscript.

Blooming Twig is an award-winning boutique publishing house, media company, and thought leadership marketing agency. Based in New York City and Tulsa, we have represented and re-branded hundreds of thought leaders, published more than 400 titles in all genres, and built up a like-minded following for authors, speakers, trainers, and organizations with our bleeding-edge marketing strategies. Blooming Twig is about giving the people with something to say (“thought leaders”) a platform, walking its clients up to their own influencer pulpit, and making sure there is a like-minded crowd assembled to hear the meaningful message.

250 copies • Completed manuscript.

Boyle & Dalton was founded in 2014 and publishes works of fiction, non-fiction, and poetry. The world of publishing is changing, we're changing with it. Our founder Brad Pauquette, conceptualized a hybrid model that balances the financial and rights model of self-publishing with the quality controls and production excellence of a traditional publisher. Our designers and editors produce exceptional books that are distributed in both print and digital formats to all major retailers, including Amazon.com and BarnesandNoble.com. Boyle & Dalton carefully consider all submissions for publication, based on manuscript quality. We do not accept erotica or children's books.

Dear Author,

You worked hard to write your manuscript, and you know that expert assistance is needed to ready it for the market. But perhaps you didn’t realize that working with a publisher is no longer necessary—especially publishers who charge fees to produce your book upfront and "share" more of your revenue whenever a book is sold.

1106 Design is an author services company that has served over 4,000 authors since 2001. We offer all the editorial and design services you’d expect from a publisher, transforming your manuscript into a polished book. But here's the difference: we help you secure print-on-demand printing and worldwide distribution in YOUR name. This means you'll earn several dollars more for every book sold instead of a meager “royalty” and never lose control of your book or your book files.

We understand that your book is not just a passion project but also a potential source of income. No two books or authors are alike. That's why we'll customize a package of services tailored to your needs at affordable prices, starting at $5,555. And here's the best part: after this one-time investment, every penny of revenue from book sales is deposited directly to your bank account, never to ours first.

If this sounds like a better way to publish your book, I invite you to browse our services, design samples, no-surprises pricing, outstanding customer reviews, and educational articles at https://1106design.com. You can download a free PDF of my book, "Publish Like the Pros: A Brief Guide to Quality Self-Publishing and an Insider's Look at a Misunderstood Industry," and request a free, no-obligation consultation.

1106 Design is rated A+ by the Better Business Bureau. We are a “Highly Recommended Expert” at IngramSpark.com and rated "Excellent" at Alli, The Alliance for Independent Authors, at SelfPublishingAdvice.org. Alli's "watchdog list" of the best and worst publishing services companies is an invaluable resource.

How can we serve you today?

Sincerely,

Michele DeFilippo, owner

250 copies • Partial manuscript.

Atmosphere Press is an independent publisher dedicated to author rights. We publish in all genres and have an exceptional editorial, design, and promotional staff. We stand for Honesty, Transparency, Professionalism, and Kindness. We want our authors and their readers to be blown away when they first hold that book in their hands. It needs to look good inside and out, and feel good to the touch. And, of course, the words need to be top-notch, and our editors are devoted to making that the case.

250 copies • Partial manuscript.

Authors Unite helps you become a profitable author and make an impact. We take care of printing and distribution through major online retailers, developmental editing, and proofreading with unlimited revisions. We take care of the entire process for you from book cover design all the way to set up your backend so all your book royalties go straight to your bank account. We can also help with ghostwriting if you prefer not to have to figure out all the steps on how to write a book yourself.

With our book marketing services, you don’t need to worry about figuring out all the steps on how to market a book or how to become a bestselling author. We’ve helped hundreds of authors become bestselling authors on Amazon, USA Today, and The Wall Street Journal. We take care of the entire book launch process for you to help you sell thousands of copies of your book and become a bestselling author.

View case studies here: https://authorsunite.com

100 copies • Partial manuscript.

Bookmobile provides book printing, graphic design, and other resources to support book publishers in an ever-changing environment. Superior quality, excellent customer service, flexibility, and timely turnarounds have attracted nearly 1,000 satisfied clients to Bookmobile, including trade houses, university presses, independent publishers, museums, galleries, artists, and more. In addition, we manage eBook conversions and produce galleys, and regularly provide short-run reprints of 750 copies or fewer for major publishers such as Graywolf Press.

100 copies • Completed manuscript.

Happy Self Publishing has helped 500+ authors to get their books self-published, hit the #1 position in the Amazon bestseller charts, and also establish their author website & brand to grow their business. And the best thing is, we do all this without taking away your rights and royalties. Let's schedule a call to discuss the next steps in your book project: www.meetme.so/jyotsnaramachandran

Get your ebooks into the biggest stores and keep the 100% of your royalties. Amazon, Apple iBooks, Google Play, Kobo, Nook by Barnes & Noble and more.

THE CHINESE ARE the longest continuous civilisation on earth going back 5,000 years. It’s an ethnically homogenous society with 92% of its inhabitants being Han Chinese although it has 56 minority ethnic groups. China has almost no citizens of non-Chinese descent – it is unheard of for a person who is not ethnically Chinese to be granted citizenship (Hong Kong and Macao operate different rules for acquiring citizenship). Every foreign encounter on its shores or lands in the last 300 years have led to an invasion or occupation of some kind, therefore, to say the Chinese are wary of foreigners in their country is an understatement – and they have every right to be.

The official position in China is that racial discrimination does not exist - this is based on a quotation from Dainzhub Ongbodin in 2007 as the vice director of the State Ethnic Affairs Commission;

"All ethnic groups in China are equal and no racial discrimination exists."

Not surprisingly, it’s virtually impossible to find data, court records, reports etc. on the subject in the Mainland. What you will find are the occasional reports from foreign writers discussing discrimination they have witnessed against somebody else or experienced themselves. And of course, foreigners who have lived in China will give their own personal accounts. Given the sensitivity of the subject and in the absence of data I can corroborate in Mainland China, I will rely on commissioned reports, statutes, international treaties, court cases and official policy statements in Hong Kong as these are available. Yes, Hong Kong is the most westernized and liberal part of China but some account of how the issue is addressed there will give an indication of what it could be like elsewhere. Given the lack of reliable data in Mainland China, I will have to rely on reasoning by analogy.

To address diversity, the Hong Kong Equal Opportunities Commission (EOC) had been set up to support the implementation of the Race Discrimination Ordinance (RDO) as well as the other discrimination ordinances that were enacted in 2008. As a body, they have quite extensive powers that allow them to look into any policy or practice that contravenes the provisions of the Discrimination Ordinances with the view to bringing legal action against any violators. However, as at the time of publication, not a single case has been brought to the courts by the EOC - the first case brought under the Race Discrimination Ordinance was privately funded and heard in 2014; six years after it came into force. The law is quite clear on the subject in Hong Kong; racial discrimination against ethnic minorities is permitted if:

1. It serves a legitimate purpose (e.g. asking certain people to be proficient in written Chinese for a job) – Section 4(2) of the RDO;

2. It is on the grounds of nationality or immigration – Section 54 and 55 of the RDO;

3. It involves allocating space in a cemetery, crematorium or columbarium – Section 32 of the RDO.

Overall, the findings dispelled the myth of a blanket intolerance towards ethnic minorities but actually showed a clear bias towards race based on skin tones with White Caucasians having the highest level of acceptance of ethnic minorities and apparently seemed to score higher than the acceptance of other Chinese by Chinese. But the acceptance level slowly declined as other “darker” ethnic minorities were surveyed.

After White Caucasians, acceptance levels trended down to Japanese (acceptance level of the Japanese is very different in Mainland China because of the atrocities of Nanking), then Koreans, followed by a host of other South East Asian nations such as Indonesians, Malaysians, Filipinos, Thais, Vietnamese, Cambodians and other smaller nationalities that form a very small percentage of the total population of ethnic minorities. The results then trended down even further when considering Indians, Pakistanis, Bangladeshis and Nepalese followed by Africans and/or Arabs. This trend can also be confirmed when one looks at the plethora of news reports citing discrimination and unfair treatment of minorities.

Given the clear trend away from Whites, Japanese and Koreans, a more recent study decided to look even further into the divergence of acceptance when it came to particular ethnic minority groups. In a study conducted by the Hong Kong Equal Opportunities Commission in partnership with Policy 21 (a University of Hong Kong subsidized Research Services Centre) into the areas of life that formed the basis of the 2008 Racial Acceptance Survey, 19 focus groups comprising 107 Chinese and South Asian stakeholders were organized.

The findings by and large mirrored all other previous surveys and studies before it: Chinese respondents had a very high acceptance level for Caucasians, Japanese and Koreans but a much lower acceptance level for other minorities which declined as the race and skin colour of the ethnic minority became an issue. These results can be corroborated by Euromonitor International reports which show that China is the world’s largest market for skin whitening products across both whitening sub-sectors; and facial masks. Not surprisingly, the second biggest market is Taiwan which has the second largest population of Han Chinese in the world (about 95% of the population).

The criminal justice system is never questioned in Hong Kong so the first case brought against a Hong Kong Police officer was quite recent and drew a lot of attention; Singh Arjun by His Next Friend Singh Anita Guruprit v Secretary for Justice for and on behalf of the Commissioner of Police and Another [2014] HKEC 371 (District Court); [2014] 5 HKC 225 (Court of Appeal).

This particular case was merely a slight altercation (brushing past a person on an escalator) at an MTR station but what made this notable was the treatment of both “complainants” (both alleged the other party was the perpetrator). One complainant was an ethnic minority teenager of Indian descent and the other a middle-aged Han Chinese woman but the Police Officer completely dismissed the testimony of the teenager, hadhim arrested, declined to investigate CCTV footage, detained him for several hours while a Punjabi interpreter was summoned despite the teenager insisting that he only spoke English.

This case is notable not for the actual material facts of the altercation but its significance in how the courts ruled on the application of the Race Discrimination Ordinance and its application to the Police Force. Mr Arjun Singh (the teenager who was arrested) was the first person to sue the government for racial discrimination citing that it failed to provide policing services to him on account of his ethnicity. After 20 months of submissions in a discrimination case that took place in 2009 involving an 11-year old child, the Court of Appeal in 2016 held that acts of the Hong Kong Police are not subject to the Race Discrimination Ordinance and by extension, the government is under no obligation to follow race discrimination laws.

The author hasn't added any updates, yet.

$6

0 readers

• Signed Limited Edition paperback

• Ebook (PDF, ePUB, MOBI)

1 copy + ebook included

Free shipping within the UK

Includes:

$25

0 readers

• Signed Limited Edition Hardcover and paperback

• Ebook (PDF, ePUB, MOBI)

2 copies + ebook included

Free shipping

Includes:

$50

0 readers

• Signed Limited Edition Hardcover Book

• Ebook (PDF, ePUB, MOBI)

• 4 oz. bag of Jamaica Blue Mountain® coffee (beans, ground coffee or T-bags™)

1 copy + ebook included

Free shipping

Includes:

$75

1 reader

Signed Limited Edition Hardcover Book

• Ebook (PDF, ePUB, MOBI)

• 4 oz. bag of Jamaica Blue Mountain® coffee (beans, ground coffee or T-bags™)

• Your name printed in the Acknowledgement in every edition of the book – forever (an edition will be produced every year to keep up with changing Chinese laws and regulations).

1 copy + ebook included

Free shipping

Includes:

$250

0 readers

• 12 Signed Limited Edition Hardcover Books

• Ebook (PDF, ePUB, MOBI)

• 4 oz. bag of Jamaica Blue Mountain® coffee (beans, ground coffee or T-bags™)

• Your name printed in the Acknowledgement in every edition of the book – forever (an edition will be produced every year to keep up with changing Chinese laws and regulations)

12 copies + ebook included

Free shipping

12 copies + ebook included

Includes:

$500

0 readers

30 Signed Limited Edition Hardcover Books

• Ebook (PDF, ePUB, MOBI)

• 4 x 4 oz. bag of Jamaica Blue Mountain® coffee (beans, ground coffee or T-bags™)

• Your name printed in the Acknowledgement in every edition of the book – forever (an edition will be produced every year to keep up with changing Chinese laws and regulations)

30 copies + ebook included

Free shipping

Includes:

$1000

0 readers

30 Signed Limited Edition Hardcover Books

• Ebook (PDF, ePUB, MOBI)

• 4 x 4 oz. bag of Jamaica Blue Mountain® coffee (beans, ground coffee or T-bags™)

• Your name printed in the Acknowledgement in every edition of the book – forever (an edition will be produced every year to keep up with changing Chinese laws and regulations)

30 copies + ebook included

• A total of three hours of Skype or one-to-one consultations on Chinese market entry, entry strategies for start-ups or any related area of the author’s expertise.

Free shipping

Includes:

$5000

0 readers

50 Signed Limited Edition Hardcover Books

• Ebook (PDF, ePUB, MOBI)

• 10 x 4 oz. bag of Jamaica Blue Mountain® coffee (beans, ground coffee or T-bags™)

• Your name printed in the Acknowledgement in every edition of the book – forever (an edition will be produced every year to keep up with changing Chinese laws and regulations)

50 copies + ebook included

• A total of five hours of Skype or one-to-one consultations on Chinese market entry, entry strategies for start-ups or any related area of the author’s expertise.

• A 5000-word report on Chinese market entry for your business or corporation

Free shipping

Includes:

$10000

0 readers

100 Signed Limited Edition Hardcover Books

• Ebook (PDF, ePUB, MOBI)

• 20 x 4 oz. bag of Jamaica Blue Mountain® coffee (beans, ground coffee or T-bags™)

• Your name printed in the Acknowledgement in every edition of the book – forever (an edition will be produced every year to keep up with changing Chinese laws and regulations)

100 copies + ebook included

• A total of five hours of Skype or one-to-one consultations on Chinese market entry, entry strategies for start-ups or any related area of the author’s expertise.

• A 20,000-word report on Chinese market entry for your business or corporation.

Free shipping

Includes: